AI has taken the world by storm, and it has found its way into the FinTech sector, too.

It has the potential to revolutionize the way financial institutions operate by streamlining processes, improving decision-making, and enhancing customer experiences.

If you are unsure how you can benefit from it, read on to check 8 examples of how to use AI in finance.

Let’s dive in!

The 7 Key Benefits of AI in Finance

From fraud detection to personalized financial advice, AI offers a multitude of opportunities to gather insights, automate processes, and optimize operations.

Let’s check some of the key benefits in the FinTech sector:

- Improved accuracy

AI algorithms are capable of analyzing vast amounts of data with high accuracy, leading to more exact financial predictions and analysis.

- Increased efficiency

AI can automate repetitive and time-consuming tasks, such as data entry and processing, freeing up employees to focus on more complex tasks.

- Cost savings

AI can help financial institutions reduce labor costs and operational expenses by automating tasks and improving efficiency.

- Better decision-making

AI can analyze large amounts of complex data in real-time to identify patterns and make predictions, helping financial institutions make better decisions.

- Personalized customer experiences

AI algorithms can help FinTech companies tailor their products and services to individual customers, providing a more personalized experience and increasing customer satisfaction.

- Enhanced security

AI can help detect and prevent fraud and cyber threats, improving the overall security of financial operations.

- Improved compliance

By automating compliance tasks, AI can help stay up-to-date with regulations and requirements, reducing the risk of penalties or fines.

How to Use AI in Finance – 8 Use-cases To Simplify Tasks

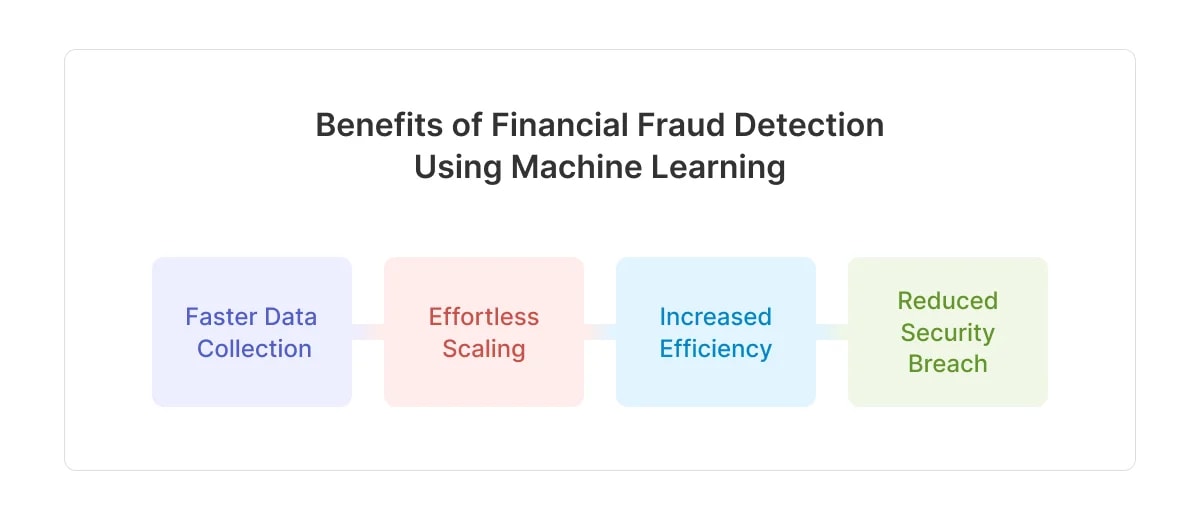

1. Fraud Detection

AI-powered algorithms can detect potentially fraudulent transactions by analyzing millions of data points and identifying anomalies.

Thus, AI can:

✨ Verify the identity of users during the onboarding process, reducing the risk of identity theft.

✨ Analyze user data to create customized risk scores assessing how likely the user is to commit fraud.

✨ Analyze text data, such as social media posts and chat logs, to identify potential fraudsters and their methods.

✨ Detect fraud at an early stage, preventing potential financial losses and protecting the reputation of your company.

Furthermore, AI's ability to learn from data serves as a powerful tool to identify patterns and create profiles of fraudulent behavior.

Consequently, as new fraud schemes emerge, AI can update its profiles and detect similar patterns in real time.

2. Risk Assessment

AI can analyze credit risk taking into account factors such as credit history, payment behavior, and other relevant financial data.

By assessing these factors, AI can provide more accurate credit scoring to reduce your financial risks.

What’s more, analyzing customer data enables AI to segment customers based on their financial history and risk factors.

Therefore, you can personalize loan products, interest rates, and repayment terms depending on the individual customer's risk profile.

In addition, AI algorithms can analyze interest rates, market trends, economic indicators, and customer financial profiles to help you make more informed decisions about lending.

3. Loan Processing

With AI, you can automate the processing, signing, and management of financial documents, allowing for a faster and more efficient loan application process.

AI eliminates manual data entry and reduces errors due to its ability to extract and analyze data from bank statements, tax returns, and other financial documents.

Moreover, AI can analyze and process credit scores, examine bank transactions, debt-to-income ratios, and other financial data to assess a client's creditworthiness.

AI's potential in loan processing is significant for both parties.

It provides faster, more efficient, and personalized loan processing for clients while providing a more accurate risk assessment for you as a lender.

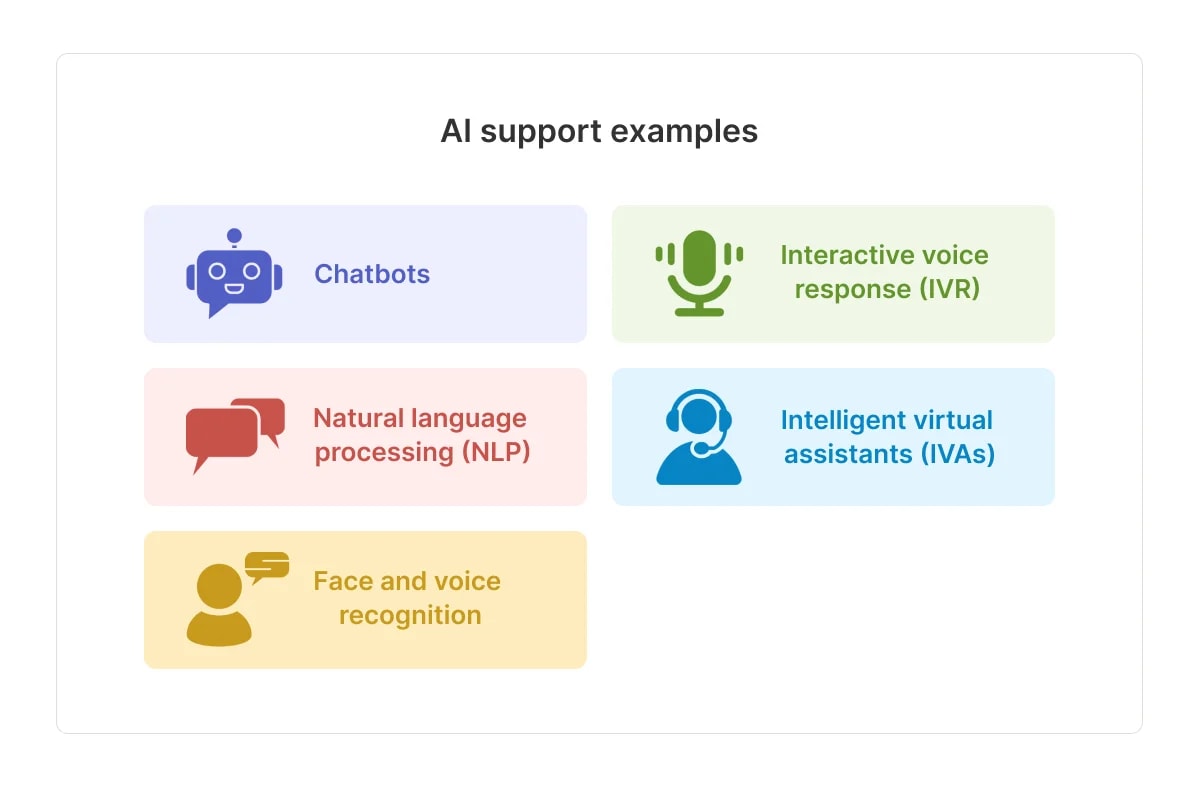

4. Customer Support Around The Clock

Chatbots and virtual assistants provide quick responses to customer queries without the need for human intervention, making them a very popular solution.

They can handle a high volume of customer requests simultaneously, so you can scale your customer support operations without increasing the staff size.

Therefore, these tools reduce costs by automating routine support tasks.

Furthermore, you can train them to tailor their responses to individual customers, providing a more personalized experience.

FinTech is a broad industry, so depending on your sector, you can use chatbots and virtual assistants to:

✨ Help customers access account information, pay bills, and transfer money.

✨ Assist clients with various trading-related tasks such as buying stocks, tracking market trends, and researching investment options.

✨ Handle customer requests related to insurance policy updates, claims, and premiums.

✨ Help clients during the loan application process, answer common questions about loan products and services, and provide personalized loan recommendations, etc.

💡 ProTip:

TextCortex's ZenoChat leverages AI, NLP, and machine learning on user queries to produce automated responses.

It allows you to rewrite, expand, summarize, adjust tone, and fix spelling and grammar errors so your messages are clear and error-free.

Furthermore, it provides multilingual support enabling you to communicate with customers and clients globally.

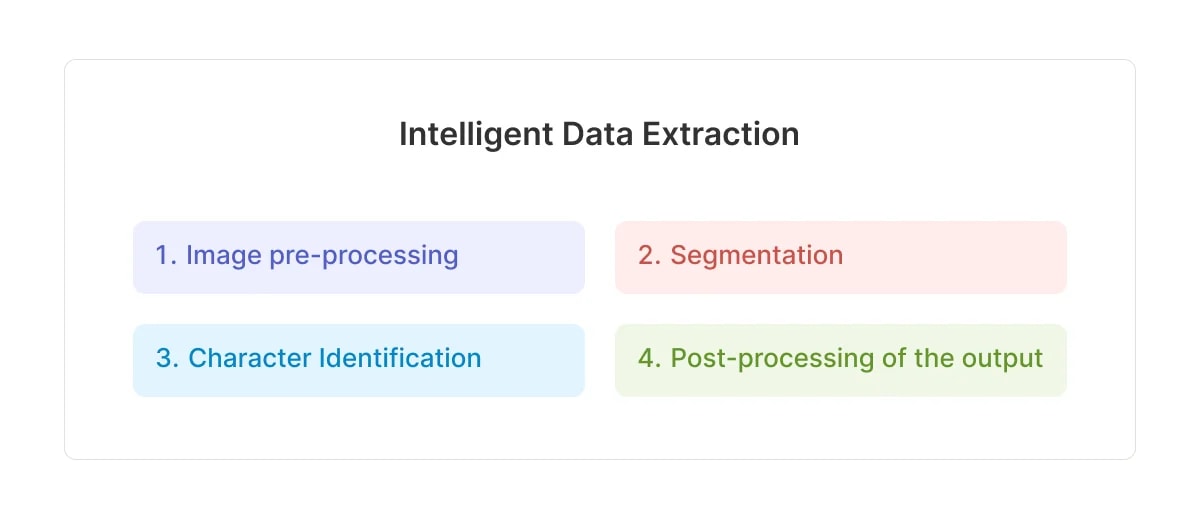

5. Data Extraction

Data extraction using AI automatically identifies and extracts structured data from unstructured or semi-structured sources, such as text documents or email messages.

It can precisely locate relevant data points in these documents and extract them into structured data formats like CSV, Excel, or JSON for further processing and analysis.

How can you use data extraction to your benefit?

Let’s say you are a mortgage lender. You can use AI-powered data extraction technology to extract financial data from applicants' bank statements to assess loan eligibility automatically.

One of the biggest benefits of AI-powered data extraction is that it can automatically adapt to new and changing data formats and structures, making it extremely flexible.

6. PDF Retrieval

One of the most common textual formats in banking and finance is PDF because it retains its formatting and can include textual and numerical data.

However, finding the info among a great number of PDFs is a different story.

AI speeds up the process of retrieving PDFs based on user requests.

For example, it can retrieve a bank statement for a given period, and then the AI chatbot can pull the relevant PDF from the database and send it to you.

Moreover, AI can summarize PDF contents, making it easier to understand key points quickly, which is particularly useful when dealing with lengthy financial reports or contracts.

You can also leverage AI to compare PDFs and highlight differences between them.

For instance, you can compare a loan application with a credit report to identify any inconsistencies.

💡 ProTip:

The Knowledge Bases feature by TextCortex enables you to upload various documents such as PDF, DOC, PowerPoint, and CSV as data sources.

You can name the knowledge bases you create and edit them later.

This feature allows you to summarize hundreds of pages of documents or translate them into another language with a single click.

Furthermore, you can also ask for specific information, use this feature to compare two different documents, and complete your data analysis tasks in minutes.

7. Investment

AI has a versatile use within the Investment sector and can help you:

- Optimize investment portfolios by analyzing vast amounts of data to identify profitable investments while minimizing financial risk.

- Analyze social media trends and news articles to gauge market sentiment.

- Assess any investor's risk profile and recommend investment products that align with their tolerance for risk.

- Get investment recommendations, suggestions, advice, details on stock performance, etc.

8. Insurance

With the help of AI, insurance companies can personalize their products and services to their customers, offering tailored policies with competitive pricing based on individual needs.

Therefore, AI can be of great help with:

✨ Automating and streamlining the claims processing workflow.

✨ Detecting fraudulent activities in claims data, thereby reducing fraudulent payouts and improving profitability.

✨ Automating the underwriting process by analyzing large amounts of data and identifying high-risk applicants, helping you charge appropriate premiums.

✨ Assessing an applicant's risk profile and recommending insurance products that align with their needs.

✨ Personalizing insurance policies to the unique needs of each customer.

✨ Predicting future market trends, enabling insurers to make better investments and manage risks proactively.

Wrapping It Up

Using AI in Fintech can significantly improve your business operations without compromising their quality.

Besides automating operational processes, it can also save time and money and make you more efficient.

If you’re unsure where to start, we have a suggestion: an intuitive solution whose AI models you can customize to meet specific business needs.

Enter, TextCortex! 🚀

How Can TextCortex Streamline Your FinTech Operations?

TextCortex is an AI-powered content creation tool whose scope goes beyond mere content creation.

Our stellar feature ZenoChat helps you simplify and automate multiple operations and create tailored approaches to meet your personal needs.

It allows you to customize the bot's personality, create chat scenarios, and orchestrate user interactions, making it a robust engagement tool.

With our "Individual Personas" feature, you can adjust ZenoChat's output style, tone of voice, sentence length, and reading ease.

Furthermore, you can build an AI persona that uses your brand's tone of voice, and it will complete your text-based tasks.

In addition, you can also:

🔥 Transforms at least 3 bullet points into a comprehensive email, streamlining email creation.

🔥 Polish and adjust your writing with our rich text-editing features and rewrite, summarize, and change the tone of voice.

🔥 Integrate Zeno with 30,000 websites and apps.

🔥Translate in more than 25 languages.

🔥 Access a vast amount of info with our Knowledge Bases.

🔥 Leverage more than 60 AI templates for a highly tailored approach.

🔥 And so much more.

Sign up for your freemium account and reap the benefits TextCortex brings to the FinTech industry.

.webp)